- News & information

- About

- History

- George V. Voinovich

- George V. Voinovich Collection

- Calendar

- How to Find Us

- News

- Archives

- Photojournalism Fellowship Project

- Photo Essays

- Current Fellow

- Previous Fellows

- Reports and Publications

- Archives

- Students

- Prospective

- Center for Entrepreneurship

- Environmental Studies

- HTC/Voinovich School Scholars

- Master of Public Administration

- Current

- HTC/Voinovich School Scholars

- Center for Entrepreneurship

- Environmental Studies

- Master of Public Administration

- Alumni

- Contact

- School Leadership

- Strategic Partners Alliance

- Ohio University Public Affairs Advisory Committee

- Ohio University Public Affairs Advisory Committee

- Faculty and Fellows

- Faculty

- Visiting Professors

- Voinovich Fellows

- Professional Staff

The Limits of Exponential Economic Growth?

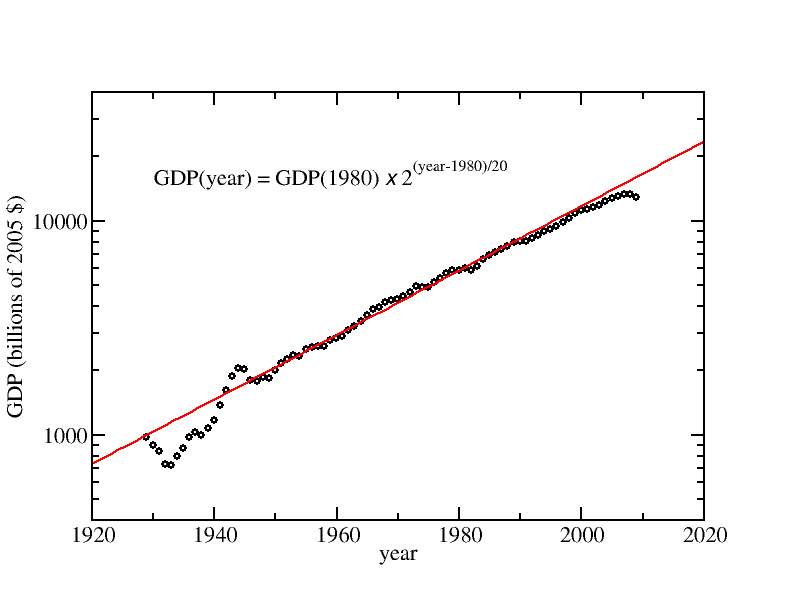

Consider for a moment this graph:

The solid points are inflation-corrected U.S. Gross National Product (GDP) as a function of year. Source: U.S. Department of Commerce, Bureau of Economic Analysis ( http://www.bea.gov ). The solid red curve is the exponential growth formula with a doubling time of 20 years.

The productivity our nation has increased tremendously over the past 80 years. Similar plots can be constructed using the various stock market averages or the annual federal budget. They may or not be corrected for inflation and/or normalized to be per person. No matter how you slice it, the curves show a remarkable and nearly exponential growth over this time period. For the particular case of inflation-corrected GDP plotted above, the data are well described by a doubling time of 20 years.

What is responsible for this growth? I believe it is largely due to technological innovations. These innovations have greatly increased our efficiency. For example, consider the improvements in transportation (automobiles and airplanes) and communications (television, internet, cell phones,...). There is also automated manufacturing and all of those great things computers can do.

For how long can this exponential growth continue? I do not know. Financial planners appear to have considerable confidence in it. I am skeptical. I believe there are limits to what technology can do. On one hand we are constrained by the laws of physics. We must also contend with the limited natural resources we have on our planet. Exponential growth cannot go on forever. The question is how and when will it end. It's interesting to google "Moore's Law" -- it's a similar concept with similar questions, but is more specific (micro).

In 1940, quantum mechanics was brand new and the various disciplines of engineering were just emerging. In retrospect, one can see that the foundation for many decades of growth was in place. The situation now is much more mature. While I cannot be sure, it appears likely to me that we are entering a period of more incremental innovation. We are also running into the limits of our energy resources to a greater degree. The future may well hold a flattening of our GDP growth. Blind faith in continued exponential growth certainly looks unreasonable.

What would be the consequences of slowing innovation and a flattening of GDP growth? There are a myriad, and they are generally not good. Here are a few:

- Return on investment. It will become increasingly difficult to find safe investments which will return profit at historically "normal" levels. This will make saving for retirement more problematic. In the past, it has been possible to earn about 8% annually with low-risk investments. Pension plans typically make this assumption. We may face a crisis of underfunded retirements and pensions in the future.

- Budget deficits. The federal government has traditionally run with a modest annual deficit. So far, this has been of little consequence because the deficit, as a percentage of the GDP, has remained constant. Essentially, a growing economy implies growing growing tax receipts. We may find it increasingly difficult to keep the federal budget deficit at manageable levels. The looming Social Security shortfall may be worse than generally predicted.

- As our products become more mature, they tend to become commoditized -- with lower profit margins and greater likelihood of being produced outside of the United States. There is also a tendency for the product life cycle to lengthen as newer models aren't that much better than older ones. None these factors are good for business.

It is truly difficult to predict the path innovation. Perhaps we will go through a few stagnant decades (dark ages) and then things will pick up again. I can certainly see potential areas for innovation: e.g. alternative energy, genetics/medicine, and quantum computing. But will a transformative breakthrough ever take place in these areas? My PhD advisor Ralph Kavanagh (RIP) was fond of reminding people that practical fusion energy has been "20 years away" ever since World War II.

I'm writing this on the eve of the November 2010 midterm elections. The economy is not doing so well. There is considerable debate regarding what type of stimulus, tax cuts, and/or "quantitative easing" is needed to "fix" the economy. I can't help but think they are barking up the wrong tree. The government can do some things to help spur innovation (e.g., support for education and research, tax incentives), but we shouldn't fool ourselves into believing there are easy fixes.

Let's shift gears a little bit. I really like this photo:

My dad and his siblings, circa 1934 (dad is the second from the left).

They grew up on a farm near Optima, in the Oklahoma panhandle,

without running water or electricity.

These were rough economic times: think Great Depression, Dust Bowl,

and the Grapes of Wrath. Their lifetime has spanned the

period of economic prosperity shown in the first figure.

I suppose my message could be taken as depressing, but that is not my intention. Looking at the the photo of my dad above, I am just thankful for the things that we have today. I am not convinced that we can (or need to) keep growing at the historical rate.

Note added 5 February 2011. It turns out that somebody has written a book about this idea: The Great Stagnation: How America Ate All The Low-Hanging Fruit of Modern History, Got Sick, and Will (Eventually) Feel Better , by Tyler Cowen, Penguin Publishing (2011). It's only available as an ebook and I have not read it...

Carl Brune / brune _at_ ohio.edu

Contact Information:

(740) 593–9381 | Building 21, The Ridges

Ohio University Contact Information:

Ohio University | Athens OH 45701 | 740.593.1000 ADA Compliance | © 2018 Ohio University . All rights reserved.